CASE STUDY

Game-changing financial platform

This data-driven investment management firm built a product to change the game in the industry.

Tech stack/tools we used: Kotlin, Groovy, Python, Micronaut, Material UI, React, Jest, Recharts, AWS, Terraform, Terraspace, Docker, Gradle, VS Code, Git, GitHub Actions, Pandas/NumPy, SQLAlclhemy, Dagster, boto3, Jupyter, Pytest, Playwright

Client

A group of quantitative analysts from one of the major financial centers founded a broker company with a clear focus on business automation and cutting-edge technological solutions

They reached out to Syberry with an idea for software that could research and execute systematic trading strategies.

Problem

Finding a tricky balance between evolving software requirements and the need for quick release

The development of an application without any alternatives on the market gave both us and the client unique opportunities and challenges. Together with the client, we gradually defined the system's behavior using prototype-first approach. This unique project did not limit possible engineering solutions whatsoever.

Despite the continuously evolving requirements, the release date remained tight and clearly defined, necessitating a specific approach to the application development process.

Solution

High-velocity engineering practices and an extended team allowing the release in time

By incorporating high-velocity engineering practices (CI/CD, TDD, trunk-based development, pair programming), extending the team size, and integrating out-of-the-box components with custom code along with a dedicated UI tool to store existing component, we successfully accelerated our work and released the MVP in accordance with the client's tight schedule.

The client can now use the platform to speed up the work of their Portfolio Managers and Risk Officers. With new functionality on the way, our client's platform will become a unique product with the potential to change the game in the stock market.

Succeed faster with Syberry

If you submit a request today, your MVP will be ready

as early as January 11, 2026

Key features

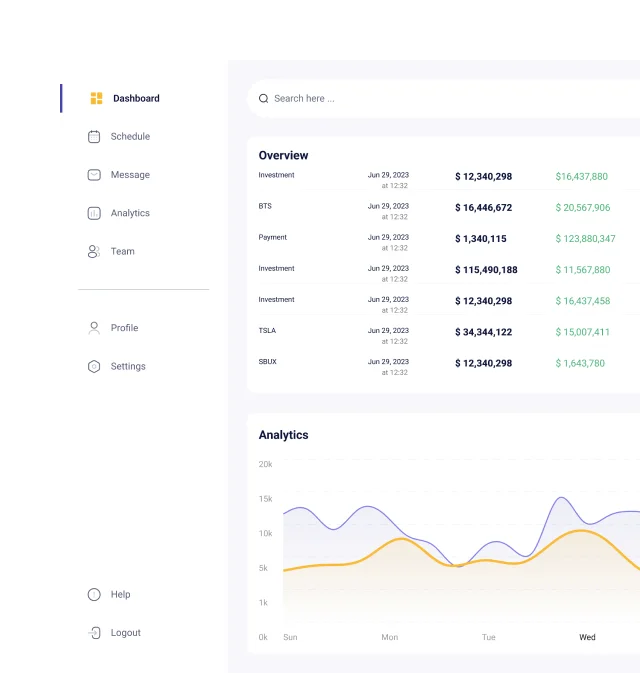

Market data streaming

With the assistance of a renowned news and information-based tools company integration, our team has successfully implemented a widget featuring real-time market streaming data. This functionality empowers Portfolio Managers to observe market indicators in real-time, facilitating informed decision-making.

Tool used for allocating risks within investment strategies

The tool gathers data from different sources and uses algorithms to predict the risk of each investment strategy. For example, weather data can help to predict risk for investments in agriculture. Recognizing that risk cannot be zero, the tool provides a benchmark for the fund's Risk Officer to make quick decisions.

News and Alerts

The tool for allocating risks within investment strategies not only gathers but also visualizes real-time market news, company announcements, and economic events that could potentially impact the portfolio. Portfolio managers have the flexibility to set up alerts for specific events or price movements. These alerts are promptly displayed as soon as the events occur, enabling swift and informed responses.

Risk dashboard

The dashboard illustrates different indicators for each strategy along with their normal range. If any indicator goes into a risky zone, the system notifies the Risk Officer. The system allows the Risk Officer to ignore the alert or take action such as adjusting the strategy risk allocation using another tool in the app.

A sandbox that extends the system's functionality

In response to the dynamic market landscape, Portfolio Managers needed a tool to quickly develop, assess, and either implement or discard their financial management strategies based on their performance. To meet these needs, we've established a secure sandbox within the system. This enables them to swiftly implement and test their proofs of concept without disrupting the core strategies of the system. Moreover, Portfolio Managers can securely share their PoCs with each other for use in real market conditions.

This feature expands the system's capabilities and enables us to examine the most popular algorithms employed by Portfolio Managers. We leverage this data to prioritize the release of new features for the system.

Multiple levels of security

As with any FinTech application, our product needs to be secure in terms of data and code storage. Whether implementing a new feature or improving an existing one, we establish the zero-trust security approach every step of the way. As an example, we have tailored supply-chain security measures for our CI/CD pipeline and established a microservice infrastructure to fortify the overall system security.

The outcome

A complex financial platform with potential to change the game in the stock market

YOU MIGHT ALSO BE INTERESTED IN...

Technology

Sales management software for a mobile device reseller

Custom software let this client adapt to the changing market conditions and focus on business growth.

Finance

Big data processing platform

Explore our client's journey from a startup to a big data powerhouse with $150M+ investments raised.

Finance, Startups

Payment processing system for a B2B FinTech startup

This entrepreneur created a disruptive payment platform for small businesses. Our client, a dynamic B2B FinTech startup, is committed to empowering small businesses with streamlined payment solutions. They aim to revolutionize traditional payment systems by offering an all-in-one invoicing and bill pay platform that eliminates fees and simplifies transactions for businesses in the United States.

Finance

AI-driven trading platform for a FinTech giant

Discover how we helped this business speed up and improve their custom software.

Succeed faster with Syberry

If you submit a request today, your MVP will be ready

as early as January 11, 2026